From property taxes to sales tax to hotel taxes, the City of Palo Alto has a lot of ways to make money. At the same time, the City also does a good job spending its funds on people, parks, services and more. How does it all add up in Palo Alto and what does the future hold for the City as it moves forward? Read on to find out how finances work in Palo Alto.

Three ways that Palo Alto’s economy is different

We hear all the time that Palo Alto is unique, but when it comes to the City’s finances, there are three factors that do make this place different from other towns in the region:

1. Palo Alto owns all of its own utilities

Palo Alto is the only city in California that operates its own full suite of utilities, including electric, fiber optic, natural gas, water and wastewater services.

This unique arrangement, which dates back to 1896, has three key benefits:

a) Palo Alto citizens generally pay lower rates for more reliable services

b) The City of Palo Alto does not have to pay high utility costs to a private company.

c) Palo Alto Utilities’ revenues are kept in special enterprise funds, which cannot be used by the City for other purposes. However because the utilities are owned by the City of Palo Alto, they pay a dividend into the General Fund every year, providing a source of revenue that is not available in other cities.

2. Palo Alto has a long history of strong property values

While home prices do fluctuate, Palo Alto’s real estate market tends to weather economic ups and downs more smoothly than other communities. Since 2000, Palo Alto home prices have steadily ticked upward despite short-term fluctuations, and this trend is expected to continue even if the current boom eventually slows down.

3. Palo Alto has Stanford Research Park and Stanford Shopping Center

Stanford Research Park, which was founded in 1951, is home to 162 buildings that hold 23,000 employees who work for 140 different companies. These companies pay property and sales taxes to the City of Palo Alto. In addition, the Stanford Mall is a consistent and significant source of sales tax for the City of Palo Alto.

Where does the money COME FROM in Palo Alto?

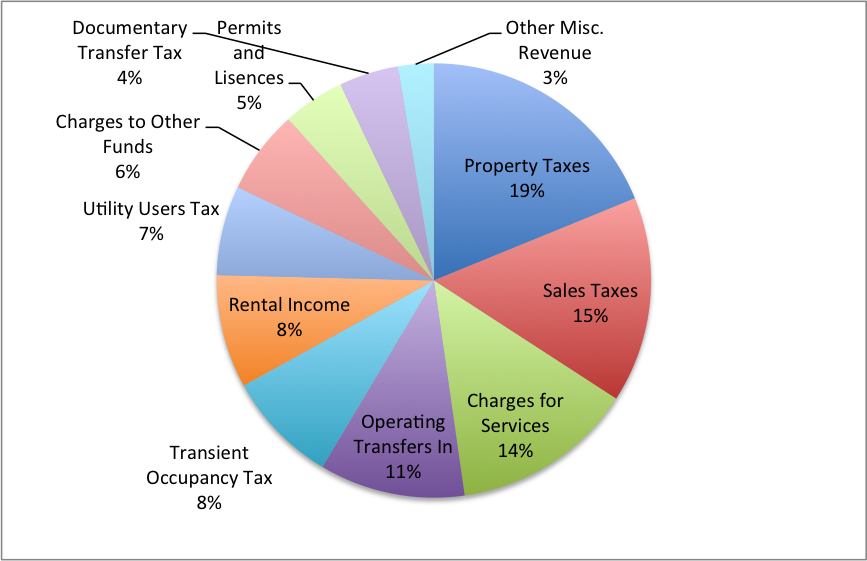

There are five tax-based sources of revenue for the City of Palo Alto’s General Fund, which make up $91M or just over 50% of the $171M:

- Property taxes: 19% of revenues [$32M]

- Sales taxes: 15% [$26M]

- Transient Occupancy Tax/hotel tax: 8% [$14M]

- Utility Users Tax: 7% [$11M]

- Documentary Transfer Tax: 4% [$7.5M]

CITY OF PALO ALTO: SOURCES OF REVENUE FOR GENERAL FUND 2015

Property Tax

Property tax is the number one source of tax-based revenue for the General Fund in Palo Alto, accounting for about 19% of general fund income. Property taxes are on the rise in Palo Alto, growing from $26M for fiscal year (FY) 2010 to $30M FY2013, and projected to be $32M in FY2015.

Residential property taxes account for the vast majority of revenue (70%), while commercial property tax brings in only about 30%.

It is important to realize that the City of Palo Alto only gets about 9% of all property tax revenue that is generated by residential and commercial real estate in Palo Alto. The majority of the revenue (57%) goes to Palo Alto Unified School District, while another 15% goes to Santa Clara County and the rest goes to the State of California and various special funds (see FY2015 budget, page 55 for details).

Palo Alto’s residential property values have been soaring in recent years, with a current median home price of $2.4M, up 33% over last year. Each residential home price sale in Palo Alto has the potential to increase the city’s property tax basis by resetting the value of each property.

Due to Prop 13, which was originally passed in 1978, residential property in Palo Alto does not get reassessed (except for tiny increments) after it is purchased unless it changes owners. As a result, the only way that property taxes go up is if houses are sold and get reassessed at the new, higher value. In years when there are fewer home sales, property taxes can flatten out or even go down if home values decline with a change of ownership (this has rarely happened in Palo Alto but is still a risk).

Palo Alto benefits from not only highly valued residential property but also from a strong commercial property base that also generates property taxes, including a portion of the revenue from Stanford Research Park.

Sales Tax

Sales tax, the second highest source of revenue in Palo Alto, is also on an uptick from $18m in 2010 to $26m in 2013.

Palo Alto is fortunate to receive the local sales tax generated by stores and tenants at Stanford Shopping Center. In 2013, the Stanford Mall sent over $5M into the City of Palo Alto’s coffers. Stanford Research Park also has tenants that generate sales tax income for the City of Palo Alto.

Palo Alto is fortunate to receive the local sales tax generated by stores and tenants at Stanford Shopping Center. In 2013, the Stanford Mall sent over $5M into the City of Palo Alto’s coffers. Stanford Research Park also has tenants that generate sales tax income for the City of Palo Alto.

The City of Palo Alto just launched a business registry that is gathering precise numbers about the companies that are located here. Until that data is available for public use, the information about businesses in Palo Alto is less exact. Office vacancy, a measure of demand for commercial space in Palo Alto, was only about 2% in 2012.

Hotel Tax (Transient Occupancy Tax)

Another element that makes the Palo Alto’s tax base unique is that the City is home to several large hotels, including the Sheraton, the Westin, and the new Epiphany Hotel on Hamilton Avenue. Guests at all hotels in Palo Alto guests pay a “transient occupancy tax” of 12% that is added to their room rate and goes to the City of Palo Alto’s General Fund. This tax generates about 8% of the income for the General Fund, or about $14M.

Hotel tax revenues have been on the rise in Palo Alto, along with occupancy and room rates, and the city’s hotels averaged about 80% occupancy with a room rate of $202 per night in FY 2014, an increase of 14% over the year before.

On the November 4th ballot, Palo Alto voters will be asked to weigh in on Measure B, a proposition to raise the hotel tax to 14% in order to fund infrastructure projects including fire stations, parks, parking garages, and the city’s bicycle and pedestrian master plan. The increased tax would bring in an additional estimated $2.4M a year and make Palo Alto’s hotel tax one of the highest in California.

Utility Users tax

In 1987, Palo Alto residents voted to institute a 5% tax on all utility usage, including telephone, gas, water and electric to pay for the lease of Cubberley from the school district and fund sidewalk and street repairs. Since this time, the tax has remained consistent even as telephone landline usage has dropped dramatically. This tax generates $11M or about 6% of the City of Palo Alto’s General Fund.

On November 4, Palo Alto voters will be asked to decide on Measure C, which proposes a reduction in the utility users tax on telephone use to 4.75% in return for modernizing the tax to include a broad swath of telecommunications usage, including wireless communications and VOIP (or voice over Internet Protocol). This proposition would not tax Internet usage, as this is prohibited by federal law. Unlike the hotel tax initiative, which aims to increase revenue, Measure C is targeted to prevent revenue loss as people switch away from landlines.

The measure also removes the discount that nine large users of utilities currently receive on this tax, including Hewlett-Packard, VM Ware, Stanford Hospital and Clinics and Stanford University.

Documentary Transfer Tax

This tax, also known as the property transfer tax, is the fifth highest source of income in Palo Alto. The tax is $3.30 per $1,000 of the sales price of a home when it changes owners. This tax is paid just once when the home sale closes and usually split between the buyer and the seller. Revenue from the transfer tax is projected to account for $7.5M or about 4.5% of the General Fund in FY2015.

Palo Alto Utilities…a special revenue source

Two Stanford University professors, Charles “Daddy” Marx and Charles Benjamin Wing, spearheaded the effort to create a city-owned utility company in 1896 to ensure that Palo Alto residents would pay reasonable costs for energy and to generate a financial return for the City.

As a result of Palo Alto’s unique utility structure, the city’s number one revenue stream is its utilities, which will bring in $273M in fiscal year (FY) ending 2015, which is about 59% of the City’s total revenue of about $465M.

The revenues from Palo Alto Utilities bring a direct bottom line impact to the City’s General Fund in two key ways:

- The City receives an equity payment every year that is related to the amount of revenue generated by the utilities. For FY2015, this payment (listed in the budget as a ‘transfer in’) will be $17.

- The Utility underwrites some of the administrative costs of running the City of Palo Alto (e.g., human resources, fire department, etc.) because these areas also support the Utility. For FY2015, this payment will be $10M (described by the City as ‘charges to other funds’).

See below for more explanation about how each of these revenue streams works, and how they fluctuate over time.

In addition, there are several other big revenue generators for Palo Alto:

- Charges for services: 13% [$23M]- includes fees Stanford pays for fire service and building fees.

- Operating transfers in: 11% [$18M)- dividend and support funds from Palo Alto Utilities.

- Rental income (mostly from facilities): 8% [$14M]

- Permits and licenses: 5% [$7.8M]

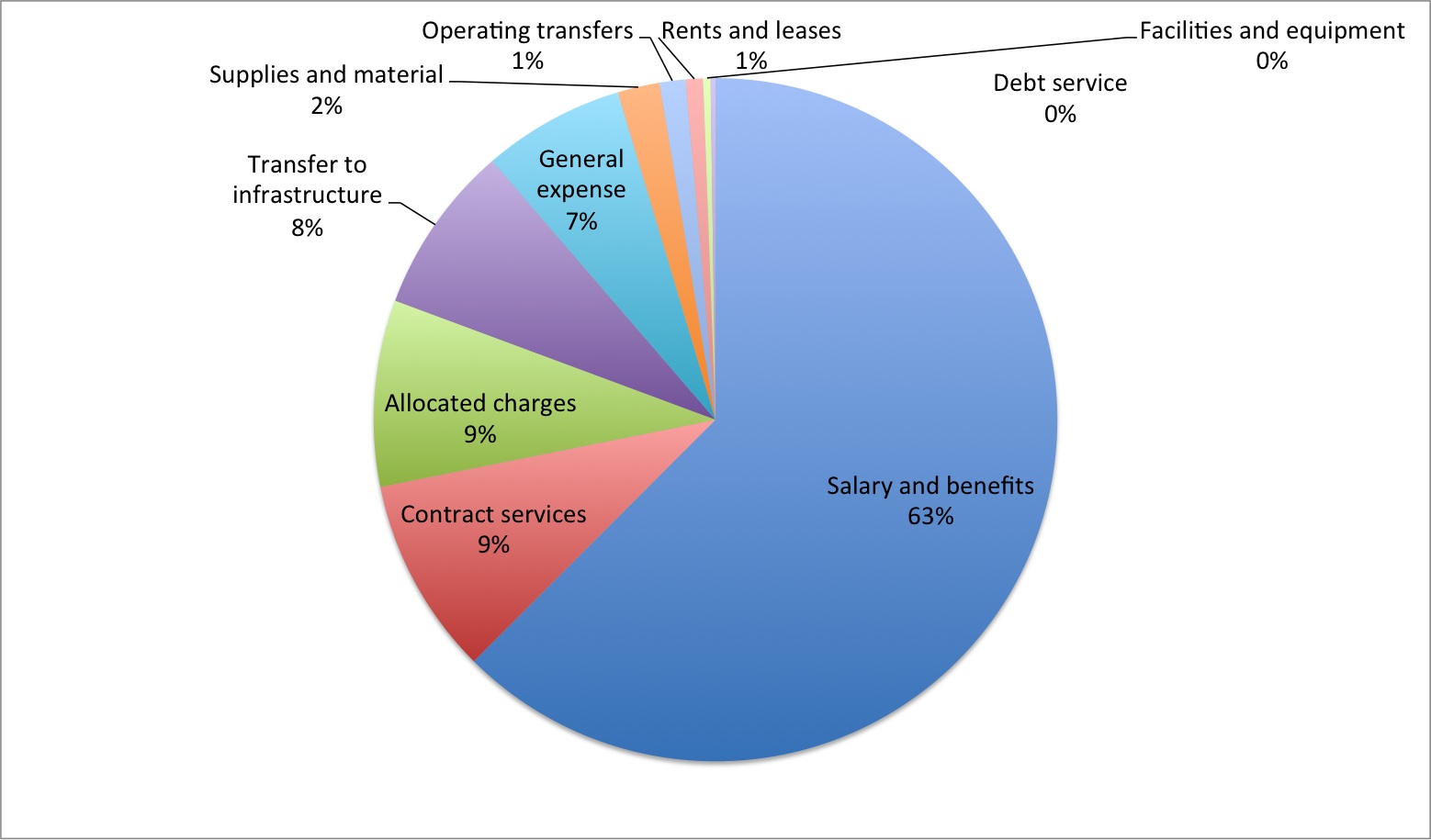

Where Does the Money Go in Palo Alto?

As in most organizations, the City of Palo Alto’s biggest expense is salaries and benefits. For FY 2015, about 62.5% of the City’s General Fund expenditures of $171M, or over $100M will be spent on the people who work for the Palo Alto.

CITY OF PALO ALTO: GENERAL FUND EXPENDITURES 2015

For FY2015, the City of Palo Alto is budgeted to have 1034 full time employees. About 50% of these employees are members of the Service Employees International Union. Palo Alto is sometimes criticized for having more city employees than other neighboring towns, but Palo Alto is the only city whose payroll includes the staff required to operate a utility company. Palo Alto Utilities workers account for about 25% of all City full-time equivalent (FTE) employees.

While nationally, health care and pension costs for public employees have ballooned in recent years, the City of Palo Alto has taken proactive steps to try and contain these costs. The cost of pensions for City employees has been on the rise every year and FY2015 costs are 15% higher than FY2014. In light of these rising costs, the City of Palo Alto negotiated a “tier 2” pension structure for new employees beginning in 2010 that is designed to stem these increases over time.

In addition to pension, healthcare for employees in the City of Palo Alto are also growing rapidly, doubling from $15M a year in 2006 to a projected total of $31M for FY2015. Given this trend, the City has capped the contribution it is making to the health care premiums of employees, a move that is projected to reduce per person monthly health care costs from $1428 to $1398 per employee in 2015.

The City of Palo Alto has a AAA credit rating, the highest rating available. However, the City is fortunate to generate enough revenue that it carries only a small amount of debt, accounting for less than 1% of the overall annual projected expenditures. The City’s other big expenses are allocated charges and contract services.

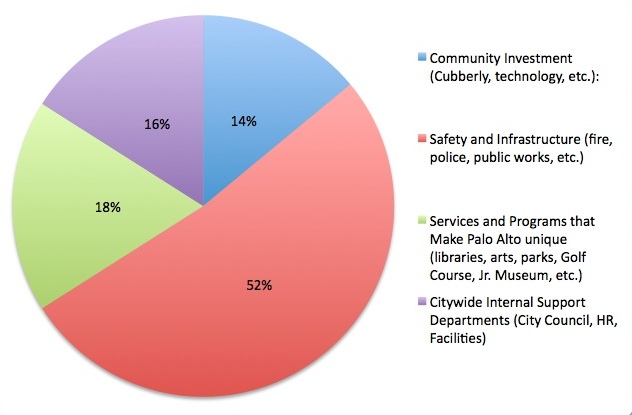

While this chart highlights where the money goes in a categorical way, the City of Palo Alto also looks at expenditures in terms how residents experience the benefits of City spending. While a majority of the expenses within each of these categories is for salaries and benefits, this chart gives a different lens on where the money goes:

Expenditures as Described by the City of Palo Alto

What’s the ‘Bottomline’ about Palo Alto City Finances?

Palo Alto is fortunate to have a diverse revenue portfolio that includes a strong property tax base along with sales tax, hotel tax and equity from the City’s utility company. As a result, the City of Palo Alto pays very little of its general fund revenues to debt service and is able to offer its residents a robust array of services, including libraries, parks, recreation and open space.

Palo Alto’s fiscal outlook for 2015 and beyond is strong, but the City experienced a significant downturn only about eight years ago when the real estate market ground to a halt due to the credit crisis. Another downturn is inevitable so the rosy picture could see some shifts in the years ahead.

In addition, Palo Alto will have to continue to work on containing costs for City employees in order to ensure that costs for health care and pensions in the years ahead remain manageable. Municipal employee costs are an issue for cities and towns across the United States. In New York City, for example, employee pension and health care payments are projected to take up 11% of its annual budget and this trend upward is expected to continue.

Knowing where the money comes from and where it goes in Palo Alto will help all of us make good decisions as we look towards the future for this unique and vibrant community.

Like what you learned here? Subscribe to Palo Alto Pulse and get more fresh news and information about Palo Alto!